Along with weighted backpacks, 45 million U.S. college students also have a heavy piggy-bank strapped to their shoulders. Once filled, the piggy-bank, now hollow, knows the borrowers’ requirement to replenish the void. It will cling-tightly until satisfied long after the backpack has been retired.

According to a Federal Reserve report in March, 45 million students owe nearly $1.6 trillion in loans across the country making it the second-highest U.S. debt behind mortgages. The average student borrows $37,000 for a bachelor’s degree, which has led to widespread anxiety and depression among students.

May is Mental Health Awareness Month, and it is no surprise that finances are the root of the majority of mental issues. A 2019 study conducted by the University of South Carolina found 90 percent of students experience anxiety and depression stemmed from their student loans.

“I wouldn’t say I’m depressed,” said Mark Strauss, 26, a graduate of Penn State’s Abington campus, about repaying his federal student loan. “I am stressed though. My dad painted apartment complexes and wanted better for me. I was drilled to do well in high school, get a college scholarship, if not, you get a guaranteed loan, graduate, and you’re set. I thought it was what everybody did, friends did, I never really thought about it.

“Since I graduated, the only job I’ve been doing is personal training. I can make good money but haven’t seen it yet. I never thought I’d still live with my mom at my age,” he said while slowly walking through a bustling gym shortly before it closed due to the coronavirus. “I owe more to Penn than my piece of (explicative) Nissan,” he said smiling.

With the average American carrying a $15,950 credit card debt according to CreditCards.com, and the new graduate saddled with close to $40,000, something seems to be inherently askew.

Theladders.com conducted a recent survey that found 90 percent of students with loans have “significant” anxiety. More than half experience depression and one in 15 students consider suicide. Sobering statistics that need to be aggressively addressed.

Josh Thompson, a journalism major at Bucks, is being proactive in avoiding such a mental state. “I’m not depressed. I do worry about paying back my loans a bit, it’s part of the reason why I’m planning on just staying at Bucks and leaving on an associate degree. I don’t want to become another statistic in the student loan crisis,” he said.

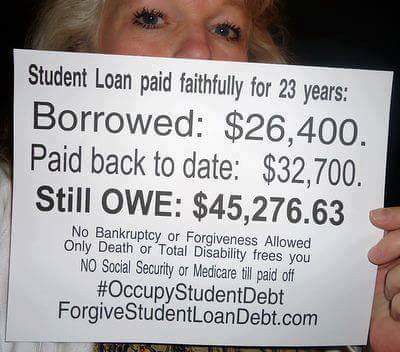

Student borrowers may encounter difficulty with auto loans, mortgages marriage, and even retirement. Additionally, failure to make loan payments will not only increase the debt, but it also devastates credit scores, garnishes wages, and may plunge students into the abyss of lifelong depression.

Student loan payments begin six months after graduation. According to the American Phycology Association, students have begun to develop spending habits within that time. It’s common for students to be ill-prepared for the monthly student loan bill which can quickly spiral out of control creating and undesirable financial state.

“I have no idea how I’m going to do anything now that I haven’t worked in so long, and didn’t get any unemployment because I’m on commission,” Strauss said in a recent phone call. “It’s like my mom is raising me all over again. You can say I’m depressed now. I know my degree is a privilege and a good thing, but I probably would be in a better situation if me and my brother just opened up our own gym. Now I’m screwed.”

Part of the reason for the student debt crisis is the soaring costs of tuitions, and decreasing salaries, making the debt to income ratio far off pace from one another. It’s difficult to pay more than you earn.

A recent United Educators study conducted over a five year period shows that student mental health issues on campuses are “growing, dangerous, and costly.” The study also revealed that the price of college tuition has increased by 250 percent in the past 30 years. Is the cost of higher education worth the mental toll?

Thompson doesn’t think so. “Nothing personal on colleges these days, but I feel they’ve taken a fall from grace. I’ve tried to get scholarships here and there, but it’s easier said than done. I’m just hoping to pay some here and there, and hopefully, by the time I really have to start making payments it’s not as expensive,” he said.

President Donald Trump signed the CARES Act in March, which includes a $2 trillion stimulus student loan forgiveness due to the coronavirus. Through September 30, 2020 student loan payments are suspended. Students will not incur late fees or penalties. Interest rates on student loans have been set to zero, and after that time, the interest rate will return to the student’s regular rate.

Forbes.com reports that nearly 12 million student loan borrowers are in student loan deferment, forbearance, or default, leaving a trail of doubt, despair, and destroyed credit. There is, however, the slimmest ray of light for those that find themselves in any of the aforementioned scenarios.

Included in the CARES Act, the federal government stopped garnishment of wages, Social Security benefits, and tax refunds from student loan debt collection, also through Sept. 30, 2020. It remains to be seen if there will be an extension of this band-aid as the coronavirus continues to claim lives.

As tuitions rise and student loan debt continues to grow, experts say it is still a wise investment in your future success. The burden of debt is a right off the passage, and maybe tedious to navigate as a young adult, but will pay off later in life with better mental health. If you find yourself experiencing anxiety or depression, you need to reach out and speak to somebody. Take advantage of counseling services offered on your campus, or call a hotline for assistance.